INDUSTRY NEWS

THE TOP 100 INDUSTRIAL LEASES OF 2023 SHOW THAT TENANTS DIDN’T GO AS BIG AS 2022

The demand slowing down for industrial and logistics warehousing shows from the smaller number of big industrial leases of 1 million or more square feet in 2023 per a report from CBRE. Read More

LUCID PLANNING TO BUILD $1B PLANT EXPANSION

Lucid group is stepping up big time at its Casa Grand EV auto plant. The company plans to spend $1 billion on Phase II of its Advanced Manufacturing Plant. Read More

PCCP PROVIDES $102M FOR SOUTHEAST INDUSTRIAL PORTFOLIO

Stoltz Real Estate Partners obtained an $102 million senior loan from PCCP LLC for a five-property industrial portfolio totaling 1.6M square feet. Read More

JACKSON-SHAW SET TO BUILD 1.8M SF INDUSTRIAL RE PARK

Jackson-Shaw is set to develop a seven-building, 1.8 million business / industrial park in Rowlett. Read More

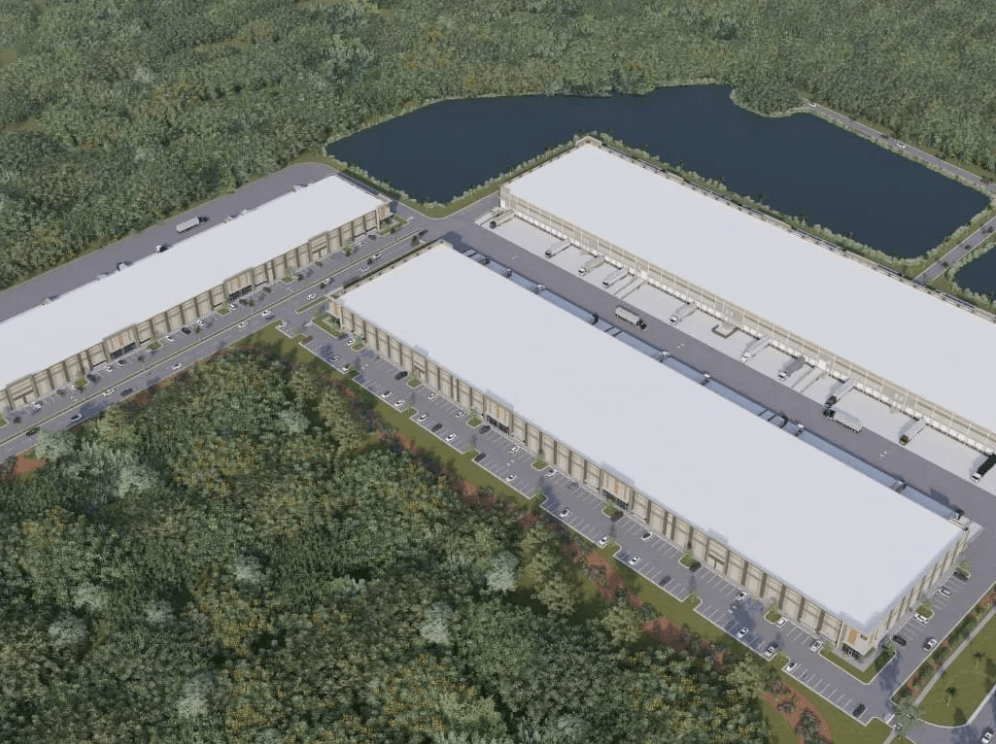

FOUNDRY BEGINS CONSTRUCTION ON 510 KSF LOGISTICS PARK IN JACKSONVILLE

The industrial real estate project in Jacksonville will consist of three buildings and will come online in late 2024. Read More

ICG CRE BREAKS RECORDS WITH INDUSTRIAL LAND SALES 3 YEARS RUNNING

ICG CRE in Chicago continues to break records with industrial land sales in the Chicagoland area with upwards of 1,200 acres sold in the last 3 years. Read More

TRANSACTIONS

CHEROKEE, AL – AE INDUSTRIAL ACQUIRES 2 MSF INDUSTRIAL FACILITY FOR $190M

Rocker Shoals, LLC, an affiliate of AE Industrial Partners, recently acquired 2.3 million square feet of industrial space in Cherokee, AL to create an aerospace hub. Read More

AZ, CO, CA, & FL – STOCKBRIDGE CAPITAL SELLS 1.7 MSF INDUSTRIAL PORTFOLIO

Two different buyers acquired the industrial real estate assets from Stockbridge Capital Group. The properties are in four major markets across the United States. Read More

WHITESTONE, IN – CBRE BROKERS TRANSACTION OF INDUSTRIAL BUILDING FOR $24.5M

CBRE brokered the deal for an industrial real estate property in Indiana for a total of $24.52 million. The asset acquired the asset at a 5.6% cap rate. Read More

DENVER, CO – INVESCO SELLS INDUSTRIAL RE CAMPUS FOR $74M

Invesco sold three industrial real estate buildings in Denver to Hyde Development and Mortenson Properties for $73.5 million. Read More

IRVINE, CA – TISHMAN SPEYER & MITSUI FUDOSAN AMERICAN ACQUIRE INDUSTRIAL SITE FOR $146M

The two companies purchased the fully entitled land for a 600K-square-foot industrial development. Read More

QUOTE OF THE WEEK

While demand has now receded moderately, it remains historically strong. However, we do not expect as many mega industrial leases in the near and mid-term as we saw in 2022.

– John Morris, President of Americas Industrial & Logistics for CBRE